As you hopefully know, the results given for screen backtests represent averages from a series of independent cycles through the data. A model with a 5-day hold will have 5 independent series of trades and, likewise, a model with a 21 day hold will have 21 independent series that are averaged together to calculate a backtest’s final stats. The advantage of this methodology is that it utilizes all the available data rather than a small fraction which many backtesting methodologies base their results on.

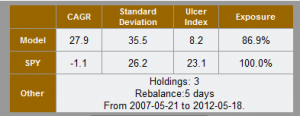

This article will take a more in-depth look at the numbers behind the averages. For this I chose a published screen by ‘inconversable’ titled CDGR – Amer. C. F. Mk 5.  This screen holds 3 positions and rebalances every 5 days. As you can see from this image, the CAGR results are shown as 27.9% versus -1.1% for the SPY.

This screen holds 3 positions and rebalances every 5 days. As you can see from this image, the CAGR results are shown as 27.9% versus -1.1% for the SPY.