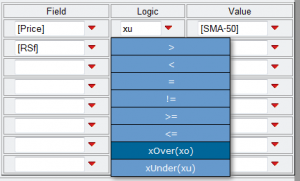

Support for cross-overs and cross-unders has been added to the new screener.  You can see from this image that a cross-over or cross-under is selected from the drop-down menu as easily as any other logic option.  The cross-under in the case shown is selecting those funds where today the price is below the 50-day SMA, but yesterday the price closed above. They only ‘select’ on the actual day of the cross, so this is distinctly different from filtering for price > or < and SMA.

You can see from this image that a cross-over or cross-under is selected from the drop-down menu as easily as any other logic option.  The cross-under in the case shown is selecting those funds where today the price is below the 50-day SMA, but yesterday the price closed above. They only ‘select’ on the actual day of the cross, so this is distinctly different from filtering for price > or < and SMA.

But don’t just think about price and moving averages with crossovers. This could just as well be used to flag symbols where RSI-2 just crossed under 10, or +DI just crossed above -DI. Oh yes, we have now broken out the sub-indicators that make up the ADX and the MACD indicators. This allows for some unique short term filtering.

Backtesting of cross-overs and cross-unders is not very meaningful since they don’t always have selections, but it is available if desired. Try out this new capability and let us know how you plan to take advantage of it.

Technical notice: For those of you that had MACD defined in your portfolio views, that has now been changed to MACD-osc, for MACD-oscillator, but the calculation has not changed. This is usually referred to as the MACD histogram when charted, but when no chart is used it is often referred to as the oscillator. The field MACD is now used to reference the actual MACD line, and MACD-sig is the Signal Line. By definition, [MACD-osc] =[MACD] – [MACD-sig] .

Suggestion:

The RSS feed link for entries or comments is broken. I would like to subscribe to this blog and have entries sent to my Google Home Page. Your web master should be able to fix this quickly and easily.

Thanks for letting us know. We have shifted the feed link to a feedburner feed which should make for a more flexible setup. Please let us know if it is still not working.