Earlier this year for our Premium Access Users we introduced the PREVAL function, or Previous Value function, which made it possible to access prior period’s data. Whether it was screening for funds which had a rising Moving Average or comparing returns from a past low, this function has found widespread use.

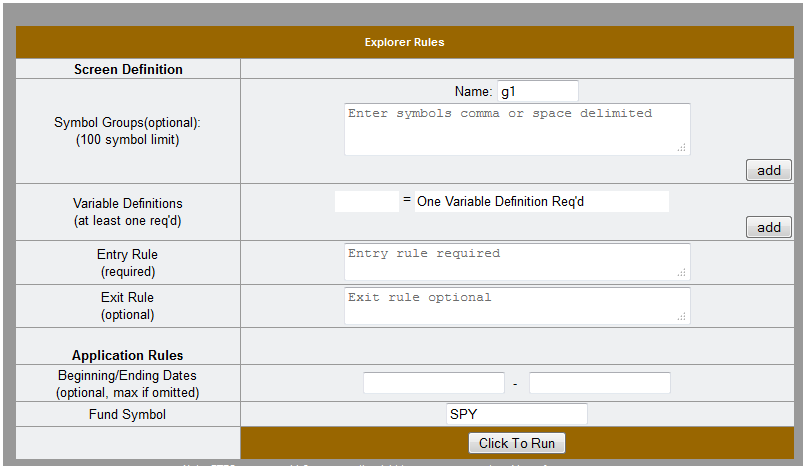

Today for our Premium Users we are happy to add the pRANK function for Percentile Ranks and the VALUE function for determining a field value for a specified symbol. These two functions add tremendous power to our screening and backtesting capabilities, and we will demonstrate samples of their use below. Continue reading