Last week I noticed a change in the Top Fund Groups table on the Home Page - Healthcare, Consumer Discretionary, and Consumer Staples groups were all among the top 5 shown. These industries are not normal leaders during a healthy market, in fact Healthcare and Consumer Staples are among the defensive industries. The obvious missing sector is Utilities, and as I write this it is in the number 6 slot and making a dash for the top five. This new look to the Top Five raised the question – How has the market performed when these industries lead?

Since this is an ETF site I wanted to look at it from that perspective, but ETF history is short. For this reason I decided to pick a Select Sector SPDR for each industry and compare relative RSf to future performance of the market (SPY). The three SPDR funds chosen were Consumer Discretionary(XLY), Consumer Staples(XLP), and Healthcare(XLV). The test period covered the 10 year span from the beginning of 2001 through end of 2010. This includes two bear markets, two recoveries, and the intermediate period.

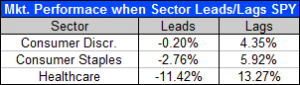

The first test run was between Consumer Staples and Consumer Discretionary. This didn’t produce any results to get excited about, but things got more interesting when the RSf of these three sectors were compared to the RSf of SPY. As you can see in the chart to the right, the market Continue reading