Last week I noticed a change in the Top Fund Groups table on the Home Page - Healthcare, Consumer Discretionary, and Consumer Staples groups were all among the top 5 shown. These industries are not normal leaders during a healthy market, in fact Healthcare and Consumer Staples are among the defensive industries. The obvious missing sector is Utilities, and as I write this it is in the number 6 slot and making a dash for the top five. This new look to the Top Five raised the question – How has the market performed when these industries lead?

Since this is an ETF site I wanted to look at it from that perspective, but ETF history is short. For this reason I decided to pick a Select Sector SPDR for each industry and compare relative RSf to future performance of the market (SPY). The three SPDR funds chosen were Consumer Discretionary(XLY), Consumer Staples(XLP), and Healthcare(XLV). The test period covered the 10 year span from the beginning of 2001 through end of 2010. This includes two bear markets, two recoveries, and the intermediate period.

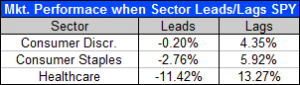

The first test run was between Consumer Staples and Consumer Discretionary. This didn’t produce any results to get excited about, but things got more interesting when the RSf of these three sectors were compared to the RSf of SPY. As you can see in the chart to the right, the market performs significantly worse when either Consumer Staples, or Healthcare, has a higher RSf than does SPY. Consumer Discretionary shows the same effect, though not as pronounced.  Consumer Staples lead SPY about 49% of the time, and Healthcare lead SPY about 44%, so either of these would be market bullish something over 50% of the time.

If you are like me and wouldn’t want to rely on a single sector for your signal, you might look at combining the Consumer Staples and Healthcare signals. Let’s say we are bullish when either of these ETFs has an RSf below that of SPY and bearish when both have higher RSf rankings. Such a scenario has shown an annualized return when bullish of 10.2% for 68% of the time and a return of -14.6% for the 32% of the time when bearish. Since a picture is worth a thousand words, they say, here is what such a scenario would have looked like.

Am I proposing this as a market timing strategy? Not in it’s current form. There are several issues lurking just beneath the surface. For one, there are often near daily changes during the transitions from a bullish period to a bearish period, and back.  I plan to spend more time on this and hopefully find a way to define cleaner transition points.

So why publish it? There appears to be significant value in knowing these relationships, and since the three relevant RSf values are published daily on this site, the effort to track this indicator is fairly minimal. Also there is timeliness, the Healthcare indicator went bearish on April 19, followed by the Consumer Staples indicator on May 2.  It might be an interesting time to watch what happens.

Here is a link to the Portfolio of the three relevant symbols.

Thanks for your site.

RSf is quite nice indicator.

I bought some RHY .

Unusual situation, but the market seems to need that.

Maybe the market will be flat for a while.

regards,

claude

I just saw a screen someone posted with the following parameters and returns:

Parameters: Long only, unleveraged only, name excludes “vix”, RSF < 75, Rtn-3d < -2

Returns: for 3 positions, 5 day rebalance: 88.2 CAGR with 49.5 SD, 7.2 ulcer, 90.8 exposure

for 1 position, 5 day rebalance: 120.1 CAGR with 76.3 SD, 10.9 ulcer, 94.8 exposure

Does this make sense to you? Very high returns with quite low ulcer indexes. Seems too good to be true.

Unfortunately I don’t see that screen on the list anymore so I’m basing my reply totally on what is in your post. That said, I would question any screen with an 88 CAGR. That’s not to say it can’t be done, just that you might want to watch it a while in real time and see if you think it has a chance going forward. I’ve been running backtests on stock and fund screens for years and I have identified some screens that performed very well going forward. I have also identified many screens that looked great, but apparently were just well tuned to the history because they fell apart when the parameters were tweaked. Change the parameters on this screen and see what happens. If it still looks solid, watch it for a few months and see how it performs. – hmt

Thanks. Will do!

Another question. It seems to me that risk would be reduced and returns increased if, rather than investing say in the top two of a 21 day screen and then rotating into the top two after 21 days, that buying the top two every week and holding 21 days, so that every week you are buying two funds and holding 21 days, for a possible total of eight funds bought in one month. Of course, you might just be buying more of the same funds if they are still in the top two. It seems this would get you out closer to market tops and rotate more quickly into whatever market is doing well or falling less.

That is a popular strategy among screen traders. I would expect it to even out some short-term peaks and troughs in one’s trade results but doubt it would be significant over the longer term. Personally I like the concept and utilize it some more volatile situations. – hmt

Thanks again for your awesome website! Is there any way that the backtesting period can be lengthened to 10 years?

Glad you like the site, thanks. We are exploring ways to expand the screener options, including lengthening the backtesting period. The caveat to a 10 year backtest of ETFs is that there just weren’t many ETFs traded 10 years ago. For example, at the beginning of 2002 there were only 116 ETFs on the market, or about 1/10 of what there are now. Depending on your portfolio that may not matter, or it could severely skew the results. – Hugh

I think it would be great to be able to backtest those etfs that were existent 10 years ago or even 7 or 8 years ago!

screen4us2 – We’re working on that as part of a bigger plan. Please bear with us. – Hugh

This is the best free site out there. Thanks for answering my questions! I have another. I just ran a screen with 5 etfs. The CAGR when I chose the top 3 was 11% and the exposure was 80%. Does this mean that if I had a portfolio with 3 equal positions that the CAGR for the entire portfolio using my screen would be 11 percent even though about 20 percent of the time not all three (none?) of the positions were filled?

Your interpretation is basically correct, but I want to clarify the 80% exposure. This means that 20% of the positions are not filled. That could be 3 positions for 20% of the time, but more than likely is a mix of 1,2, or 3 position unfilled for a longer amount of time. Other than that, you have it right. – Thanks for the questions.

Hello Hugh, Any further thoughts, or testing on this timing strategy? – Jorge

No new tests to share. This strategy would have gone bullish on 2/17 of this year, a little later than one might have hoped. The reentry price was 135.81 where the exit on May 2, last year, was 133.42 (div adjusted). A small loss, but avoided a good bit of turmoil, so you might live longer to enjoy your earnings. Over the past five years the SPY is up 7.7% while this strategy is up over 31%, with 16 trades.

Out of the market today 4/9.

The equal weight version (RSP RYH RHS) was in a week later, and also out today.

Thanks Hugh.

Bad miss on my part, I hadn’t even looked at today’s numbers. You are right, this signal just went bearish, but remember there are generally a number of flip-flops at the transition points. – Hugh

Pingback: Intro to Trend Explorer | ETF Screen

Pingback: Screener Update | ETF Screen