With Washington polarized and the fiscal cliff approaching it is no surprise the market is a bit shaky. This week the politicians gave us a Thanksgiving gift by showing an appearance of unity and then leaving town, but what will happen when they return? Do we trust that all the hostilities of the past are mended and that the same politicians that have not been able to agree on anything the past few years will now be willing to compromise? Doubtful, at least in the short term. Maybe, in the eleventh hour, but that is a long month away.

the market is a bit shaky. This week the politicians gave us a Thanksgiving gift by showing an appearance of unity and then leaving town, but what will happen when they return? Do we trust that all the hostilities of the past are mended and that the same politicians that have not been able to agree on anything the past few years will now be willing to compromise? Doubtful, at least in the short term. Maybe, in the eleventh hour, but that is a long month away.

We’ve had a nice little bounce this week, and it could be an opportunity to exit some remaining equities and buy some bonds or such. With that in mind, I took another look at published bond screens to see if anything there might be intriguing. I quickly focused in on two models, Bond TAA published by az2123, and FIXED 20 EMA 30 MO 3 published by graydrake. For my purposes I was focused on the 2-fund, 21-day, models, and that is what the links above point to.

There are differences in these two screens, but they both seem to perform well when equities do not. Bond TAA selects from a group of 9 hand-picked funds, where Fixed 20 EMA utilizes all funds in the Fixed Income group. Also, Bond TAA utilizes a blend of trailing return numbers, where Fixed 20 EMA uses a single 3-month return.

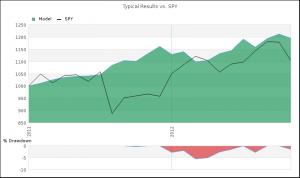

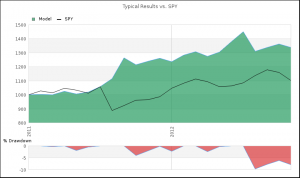

The question we’d like to know is how are these likely to perform over the next month? Obviously we don’t know that, so we’ll take a look at the 2011 period, when Washington

struggled to extend the debt ceiling. The first chart is of the Bond TAA model by az2123. This model’s stats have impressed me with a low Ulcer Index and an unusually smooth equity curve. It is worth a look.

The second model, FIXED 20 EMA 30 MO 3, by graydrake, is equally interesting. Whether you begin a backtest in 2002, 2007, or 2011, this model has returned higher CAGR but also higher UI numbers than the first model; however, a look at the charts shows much of this outperformance was in the August, 2011 time period. Will that repeat again this time? At this point, none of us know.

Both of these screens are worth taking a look at when you are looking to add some bond funds to your portfolio. The Bond TAA screen has been the more consistent, but FIXED 20 EMA 30 MO 3 is definitely worth watching.

So what are you using to select your bond funds? Tell us about it, or publish your favorite screen.

I want to spotlight a third screen that was published this past weekend, Bonds Mostly by Baltassar. This screen adds a few additional “dividend-oriented choices” to the selection list and changes the final sort to RRS-126. This is another screen that is well worth a look. – Hugh