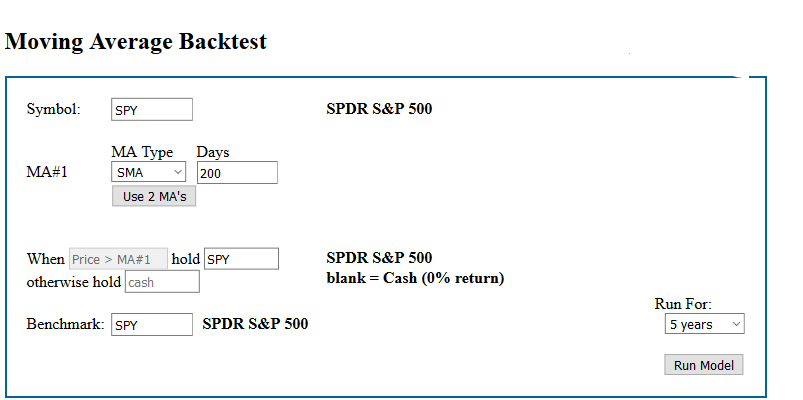

We all accept that there are spreads between the bid and ask prices we pay for our securities, but we shouldn’t assume they are all the same, nor that they are all insignificant.

♦ SPY typically trades with a spread of only 0.004%

♦ Top 10 ETFs trade with typical spreads below 0.01%

♦ Some top 1000 ETFs have spreads over 1%