We have several new features for our current screener and a new screener to announce today.

We’ll start with the boring things such as new features. Few topics are more boring than statistics, so our first new feature is a volaitlity measure, or standard deviation to be precise. These fields were actually added to the screener a few weeks ago, and a few of you have already found them under the new Volatility section of the drop-down menus. These fields will carry the abbreviation StDv-xxx where xxx is a usual time designation. The durations we currently measure range from 10-days to 1-year, though the resulting values are all annualized. By annualizing the numbers, it is straight forward to compare short term volatility to longer term volatility. However, one might want to convert these values (or the return values) if they are to be used for risk adjusting returns.

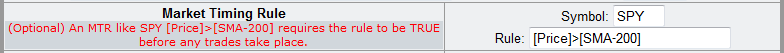

Let’s move on to a new section added to the screener called Market Timing.  We recognize this topic sparks a lot of emotion (pro and con) and considered renaming it something like Macro Trend, but decided we might as well call it what it is.  This section of the screener is totally optional but allows you to specify a symbol and a rule that must equate to true before a trade is entered. As in the example shown, you could specify that the Price of SPY is greater than the 200-day Moving Average. Whenever the price drops below the SMA-200 on a trade date, no trades will be entered. Note this is only interpreted on the periodic trade dates of the model and will not result in a trade being terminated early because this rule triggers. Several of you have asked for this and from running a few test screens it could prove to be beneficial.

This section of the screener is totally optional but allows you to specify a symbol and a rule that must equate to true before a trade is entered. As in the example shown, you could specify that the Price of SPY is greater than the 200-day Moving Average. Whenever the price drops below the SMA-200 on a trade date, no trades will be entered. Note this is only interpreted on the periodic trade dates of the model and will not result in a trade being terminated early because this rule triggers. Several of you have asked for this and from running a few test screens it could prove to be beneficial.

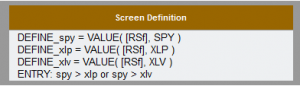

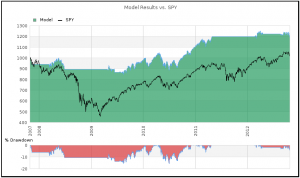

Market Timing is a great segue into a discussion of our new screener which we have titled Trend Explorer. Trend Explorer had its roots in the work I did last year for the post When the Defense Leads. In this post I explored how market performance lagged when the RSf of Consumer Staples(XLP) and Healthcare(XLY) both exceed that of the broad market (SPY). Trend Explorer basically gives you a set of tools to explore similar relationships. The image shown here  represents the code for this model, and the resulting chart is at the top of the page. Whether the knowledge gained is used for market timing a portfolio or to trade into and out of an investment vehicle like TNA or TZA, the option is yours. In addition to pulling single values as shown here, you can also SUM values or COUNT entries for a group of symbols. These fields allow you to test scenarios like when the average RSI of a group of funds is above x, or when over 50% of the funds have a price greater than the 50-day SMA. There is more explanation in this Trend Explorer post.

represents the code for this model, and the resulting chart is at the top of the page. Whether the knowledge gained is used for market timing a portfolio or to trade into and out of an investment vehicle like TNA or TZA, the option is yours. In addition to pulling single values as shown here, you can also SUM values or COUNT entries for a group of symbols. These fields allow you to test scenarios like when the average RSI of a group of funds is above x, or when over 50% of the funds have a price greater than the 50-day SMA. There is more explanation in this Trend Explorer post.

Finally, I want to provide an update on our Premium Access service that opens up a number of features including significantly more data for backtesting. For the next few days we are offering free Premium Access by following this link. We realize there has been a delay on the subscription side, but for the next few days it is free. So enjoy it!

Note: The Traditional Screener defaults to 5 years of data for a backtest. To utilize the additional data available via Premium Access enter a beginning date in the “Backtest” section at the bottom of the screen entry form. The Trend Explorer model by default utilizes the full time period for Premium Access users and 5-years of data one week delayed for non Premium Access users.Â

Just a note of thanks for all the work these improvements represent. This site deserves the support of the people who use it. I hope “Premium Access” becomes the norm.

Baltassar

PS: Any chance we could get a log scale on the y-axis, to make it easier to visualize year-over-year returns?

I know, pretty down in the weeds.

Baltassar

Thanks for the positive comments. We can definitely have a log scale. Could a log scale be the only option, or do we need to support both? – Hugh

Honestly, I think a log scale is always the best if you want to visualize the rate of return of an investment over any substantial period of time. Not a big deal, obviously, since the CAGR, SD, and UI are reported anyway. Maybe it’s just a personal preference, or what I’m used to. Not sure what it would take to support both, technically speaking. Definitely not something to go to a lot of trouble about, or if it makes the site harder to maintain.

Really appreciate the extra data back to 2001.

I second Baltassar on both counts. Great work! And a log scale would be a real plus.

I see there is a note at the bottom of the screener which says that Etfscreen.com may use any screens for whatever purpose or words to that effect. Is this still the case with premium access? Just wondering if there’s any way that my screens can be private, or at least only seen/used by etfscreen.com and myself. Thanks for your awesome updated site.

screen4us2 – I understand where you are coming from on this request and will take a look at what would be required to support it. At the moment, a screen does not technically belong to a single user unless they include a personal portfolio in it. This means that if person A and person B both run the same screen we will most likely show them the same screen, storing only one screen definition in our database. Traders have a tendency to try the same things and this allows us to benefit from that tendency. That said, I think we can work through the issues. – Hugh

Thank you so much for your efforts. I appreciate your website so much. I’ve looked at other screening websites and yours is much more user-friendly, especially for a novice. It also allows screening of so many different parameters – I’m still learning what some of them mean and how to use them.

In regard to your earlier reply, if I make a portfolio of lets say seven etfs and then screen it, is it correct that these screens would NOT be published in “Sample Recent Screens?”

You are correct, that the screen would not show up in “Sample Recent Screens”. That page only shows screens run by persons not logged in and you must be logged in to access a private portfolio. That said, there are other ways that the screen could be seen by others. For example, if you share the address with someone and they access it without being logged in, not only will they be able to see it but it could pop up on “Sample Recent Screens”. There are a few other ways as well since the site was primarily built to share rather than to hide. That is why I cannot offer even relative privacy at this point. – Hugh

There seems to be some kind of flaw in the “results by cycle” function. When I change the ETFs in a port, even drastically, the results of the backtest will change accordingly; but if I look at “trades by period” the results still include ETFs that are no longer in the group. It also omits any that have been added. Not sure what’s causing this, but for that function to work properly at present it appears that, when you change a port, you also need to change the name.

Thanks Baltassar. The results by cycle are cached separate from the screen results and that information was not being cleared out and therefore not updated. That has been corrected. – Hugh

It’s a very nice and really powerful feature, because it allows you to pull out granular data and look at things like year-over-year return, differences between pick 1, pick 2, pick 3, etc; which ETFs contribute the most over the years, and so on. Great to have it working smoothly.

Baltassar

Thanks for the explanation!

Any suggestions on how to trade the 1-day rebalancing screens?

Are they calculated from close to close?

I would think one would have to trade each day at a fixed time.

With the 5-day rebalancing, I figure the 20-minute delay in the data feed should not have a large effect. But for the 1-day rebalancing strategies, such a delay could be significant.

Hopefully someone else will jump in here with their experience because I don’t generally use screens with 1-day rebalancing. Just realize that all modeled trades are as of the market close so I would think your trading schedule would need to be as close to that schedule as possible. – Hugh

Thanks!