In this post we take a look at which funds increased in Relative Strength (RSf) through the past tumultuous 8 days. Several market technicians have claimed this as a “turning point” or a “transition point” in the market, implying what sectors have been performing the best may not perform best in the future. We take a look here at those funds that appear to have come through the fire in a stronger relative position than when they entered.

The funds below all have an RSf reading above 90 and increased in RSf from Jan 26 through today. More screen details are below if you’re interested.

The two top funds are actively managed ARK funds which have had impressive performance recently. Beyond this there are several natural resource type funds that fit the thesis of an improving economic environment and possible tightening of supply for raw materials. Of course there are select technology and biotech funds that make the list, but also note the consumer discretionary funds on the list and the banking funds. The former is also consistent with the thesis of a healthy consumer and the later with the expectation for higher rates. Possibly these are the investment themes going forward, maybe.

The two top funds are actively managed ARK funds which have had impressive performance recently. Beyond this there are several natural resource type funds that fit the thesis of an improving economic environment and possible tightening of supply for raw materials. Of course there are select technology and biotech funds that make the list, but also note the consumer discretionary funds on the list and the banking funds. The former is also consistent with the thesis of a healthy consumer and the later with the expectation for higher rates. Possibly these are the investment themes going forward, maybe.

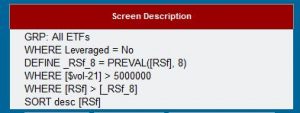

The screen rules are shown here.  It defines a field called _RSf_8 that is the RSf value from Jan 26 (8 days ago). It filters for funds with higher RSf values today. It also excludes leveraged funds and sets a minimum dollar-volume to focus the list on the more significant funds. The PREVAL() function utilized in the screen is available only to our Premium Access users, but any of those that would like to see the actual screen, or make tweaks to it, can find it here.

It defines a field called _RSf_8 that is the RSf value from Jan 26 (8 days ago). It filters for funds with higher RSf values today. It also excludes leveraged funds and sets a minimum dollar-volume to focus the list on the more significant funds. The PREVAL() function utilized in the screen is available only to our Premium Access users, but any of those that would like to see the actual screen, or make tweaks to it, can find it here.

Your new Home page and this improving RSf page are outstanding additions.

Thanks

How can I see avg volume

The average dollar-volume is included in the screen shown, but if you want average share volume that could be included as well. 5-day and 60-day average volume fields are available in the drop-downs. Just add a filter rule like [Vol-60] > 0, or [Vol-5], if you prefer a one week average. The filter will have negligible impact since few if any funds have an average volume of zero, but the field will show up in the output table.

If you prefer a different time frame you could use the TaLib library to create an SMA or EMA average of the volume field. This might be overkill for this usage, but I thought it worth mentioning.

Hugh