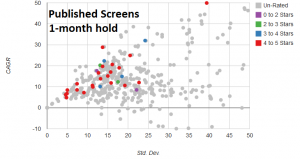

When our new Risk-Return Chart was introduced a couple of weeks ago someone asked if the distribution was any different for favorite screens that are unpublished. It was an interesting question so we did a little analysis to compare the published screens with the unpublished favorites. The chart to the left shows all published backtests for a 1-month holding period. We limited this to the 1-month screens because that is where most of the backtests are focused.

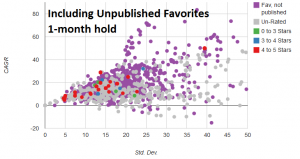

This second chart includes all unpublished favorite backtests represented by the purple dots, and the published backtests are overlayed on top. Again, this chart includes only backtests with a 1-month holding period. The first thing you will probably notice is how many favorite screens there are. The second thing you should notice with this chart is that the CAGR scale goes up to 80 while the original maxed out at 50. Obviously, there are unpublished favorites that outperform the published screens on these 5-year backtests, particularly in the higher volatility range of the chart.

Focusing on the area under a 20 standard deviation, there are published screens that are competitive with the unpublished models, even though the efficient frontier (the upper left edge of the population) is mostly dominated by purple unpublished screens. As one moves up the volatility scale the unpublished favorites truly dominate their published counterparts.

One other factor that should be stated is that Premium Access screens were not filtered out of this test and are included with the regular screens. It is not safe, however, to assume that all of the outperforming screens are using advanced functions. After spot checking a number of the better performing screens, it was clear that many did not include Premium Access features.

Bottom line, in the area of the curve where most investors are going to be comfortable, there are published screens that are competitive with the unpublished favorites even though they may not be the absolute best performing. In the higher return area, users have apparently developed screens that interest them that they have chosen not to publish (for some obvious reasons).

Hugh,

The “sample recent screens” selection on the screens page shows both published and nonpublished screens. Do I have that correct?

Thanks,

moises

I believe that is correct, but don’t have it in front of me at the moment. – Hugh

Does the premium access provide e mails about specific trades or weekly trades?

Also is there a way to have an OR statement in any synthex?