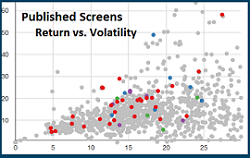

Yesterday and today we made one addition and one notable change to the site. The addition was a page to illustrate the risk – return relationship of your Published Screens.

Yesterday and today we made one addition and one notable change to the site. The addition was a page to illustrate the risk – return relationship of your Published Screens.

The chart on this page is dynamic in nature so you can zoom in and out and click any point for more information on the backtest represented. From the subsequent pop-up window you can click a link to view the backtest in full detail and then return to the chart of return vs volatility to explore another model.

We have had numerous models published the past year or two, and many of them have performed well. This page provides a new view of those models in a form that clearly separates the screens that have shown good performance from those that haven’t.

Your Star Ratings are also shown on this chart which makes it easy to see which screens other users have found most interesting. As a reminder, you can rate any backtest of any published screen from the backtest page. The only limits are you must be logged in to vote, and you can only vote for the same backtest once per month. Additionally, selecting a screen as a Favorite gives it a 5-star vote, and de-selecting it gives it a 1-star vote. We encourage you to rate those backtests which have a competitive risk/reward profile to make this chart more meaningful to everyone.

Earlier today we made a minor change to the User Variable Definition section of the screener that incorporates a pop-up form for entering and editing UV’s and a few buttons for Creating, Editing, and Deleting. This helps the user interface and error detection in a few ways, and also allows us to increase the prior 3-UV limit for our Premium Access users who were wanting to incorporate more functions in their screens.

We hope these tweaks will help your use of the site and particularly help you find and/or develop your investment strategy. We are continuing to work on custom indicator parameters and have made some significant performance improvements as of late. There are other features that you have requested, and we are working on some of those as well. Please don’t hesitate to tell us what you think about these changes and where you would like to see us go from here.

On the return vs volatility graph, it would be nice to be able to filter by the number of holdings, similar to the filter for the holding period.

Is the distribution any different for favorites that are unpublished screens?

Thanks for the request and we just added the number of holdings option you asked for.

As for comparing the published screens with the unpublished favorites, that is a great question and one I will try to answer in another post. It could be enlightening. – Hugh

Pingback: Screen Spotlight: GLD,RSP,TLT,ZIV | ETF Screen

Maybe the Ulcer Index would be more relevant than Standard Deviation?