Following up from the new functionality added to the screener a few weeks ago, today we are releasing the option to define a Supplementary Entry Rule. This rule will only be evaluated when a position is first taken, and will be ignored in subsequent periods where a position is carried over. Several of you that we’ve spoken with have asked about the purpose of this rule, while others have emailed with questions about how to test a strategy where this rule would have helped. Continue reading

Screener Updates for March 2016

It has been a while since we’ve rolled out any significant updates to our system, and we have several ready to go. Today we are adding two backtesting features and announcing a change to our data update schedule.

Taking the last item first, we are pleased to be able to begin updating the backtest data on a daily basis rather than weekly. This has been a request of several users, Continue reading

Latest on Scheduled Update

The revisions presented last week are on track for implementation this weekend, and that means that some screens that utilize volume related fields or the standard deviation field (StDv) will require some changes. We’ve received some positive feedback on the upgrade path, and we are working hard to ensure a smooth transition.

If you view a screen which you have flagged as a ‘Favorite’ you might now see a notice regarding a necessary screen revision. If you click the link, you can review the proposed changes and have the opportunity to inform us of potential problems before implementation this weekend. Obviously, we would suggest you take a look if you rely on the screen. If you do not see any type of notice this means that either the screen utilizes none of the affected fields, or you only recently flagged it as a ‘Favorite’. If the screen uses any of the affected fields, you should see some type of notice.

If you study the revisions you will see come commonality:

1. Comparisons of one volume field to another require no adjustment because the revisions will affect both sides of the equations the same. ex. [Volume] > [Vol-5d].

2. Comparisons to numeric values are converted to use the letter suffixes. ex. [$vol-21] > 2000 becomes [$vol-21] > 2m.

3. Fields used in equations or uv’s are adjusted in a default manner that divides by 1000. This has the effect of converting the number to what it is now before the changes take place. We obviously could have made this default change everywhere, but changes made in this manner are harder to read, therefore we tried to minimize their use. ex. [Volume] > 1.25 * [Vol-5d] becomes ([Volume]/1000) > 1.25 * ([Vol-5d]/1000).

Again, please let us know if you see any issues as we want the transition to be as smooth as possible. At this point we are planning to make this transition on Saturday, Jan 24.

Thanks for your continued support of our ETFScreen.com website.

Updates – January 2015

For the new year we have a number of enhancements planned including several new security types such as CEF’s, REIT’s and more. We hope to begin rolling these out next week but have several tweaks to make to the basic site before adding new pages, screens, and features. Your input on these is important. Continue reading

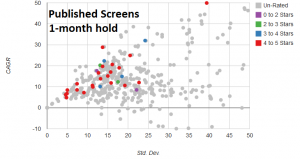

Published vs un-Published Backtests

When our new Risk-Return Chart was introduced a couple of weeks ago someone asked if the distribution was any different for favorite screens that are unpublished. It was an interesting question so we did a little analysis to compare the published screens with the unpublished favorites. The chart to the left shows all published backtests for a 1-month holding period. We limited this to the 1-month screens because that is where most of the backtests are focused. Continue reading

Screen Spotlight: GLD,RSP,TLT,ZIV

With this post we begin a new series of spotlighting the screens that show interesting performance on the new Risk Return Chart we introduced last week.

The first screen in the spotlight is “GLD,RSP,TLT,ZIV”, which is appropriately named because those are the only four symbols included in the screen. The screen backtests well and looks promising on the Risk Return chart, but that is not the only reason it was chosen. We often receive emails about how to interpret screens. This screen breaks many rules on the surface, but in the end is a very simple screen and may be effective. Continue reading

Early Summer Additions

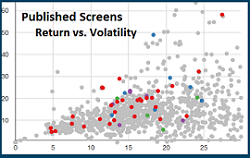

Yesterday and today we made one addition and one notable change to the site. The addition was a page to illustrate the risk – return relationship of your Published Screens.

Yesterday and today we made one addition and one notable change to the site. The addition was a page to illustrate the risk – return relationship of your Published Screens.

The chart on this page is dynamic in nature so you can zoom in and out and click any point for more information on the backtest represented. From the subsequent pop-up window you can click a link to view the backtest in full detail and then return to the chart of return vs volatility to explore another model. Continue reading

New Interactive Screener

Today we introduce a new Interactive Screener targeting the need to quickly evaluate the current market without the complexity of our advanced screener. This new screener focuses on the more common data points and comparisons to make the interface simple and smooth.

New Rank Function

Since the addition of our Percentile Rank (pRank) function last year, there have been several requests for a function to rank only the funds in the screen as opposed to all the funds in our universe as the pRank function does. Today, we are introducing the Rank function. It takes the symbols as defined in the first section of the screener and ranks them from 1 to n, where n is the number of funds being ranked.

Examples: Rank( [Rtn-3mo] ) or Rank( [StDv-1mo], INVERTED ) – Ranks funds from 1 to n based on the value of the specified field or expression with larger values having higher ranks. The keyword ‘Inverted’ reverses the order to give smaller values the higher ranks and higher values the lower ranks.

This new function may at first appear too similar to the pRank function to be of interest, but we and other users have found screen results to be different and often improved relative to the pRank function. Bottom line, it is worth trying out on your favorite screen. Continue reading

World Performance Map

Today we are introducing a new way to view ETF performance around the world by using an interactive map. The main link to this page is from the home page where you will see an image as seen on the left. Just click the image to view the color-coded map.

Today we are introducing a new way to view ETF performance around the world by using an interactive map. The main link to this page is from the home page where you will see an image as seen on the left. Just click the image to view the color-coded map.

The map is intuitive, so there is little that needs explanation, but here are a few points worth noting: Continue reading