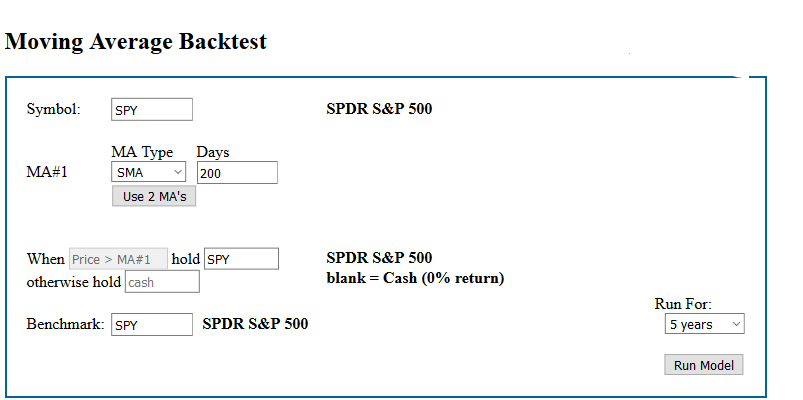

Today we are adding a new Moving Average Backtest to our modeling capabilities. This is a simplified form that allows you to test single or dual moving averages applied to a symbol or to the ratio of one symbol to another.

Category Archives: Site Info

Screener Updates for March 2016

It has been a while since we’ve rolled out any significant updates to our system, and we have several ready to go. Today we are adding two backtesting features and announcing a change to our data update schedule.

Taking the last item first, we are pleased to be able to begin updating the backtest data on a daily basis rather than weekly. This has been a request of several users, Continue reading

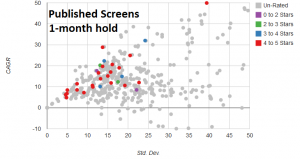

Published vs un-Published Backtests

When our new Risk-Return Chart was introduced a couple of weeks ago someone asked if the distribution was any different for favorite screens that are unpublished. It was an interesting question so we did a little analysis to compare the published screens with the unpublished favorites. The chart to the left shows all published backtests for a 1-month holding period. We limited this to the 1-month screens because that is where most of the backtests are focused. Continue reading

New Screener Features

This post introduces three new features for the screener:

- Hold Thru Rank Option

- Access to Previous Values

- Improved Error Detection

Hold Thru Rank is the ability to not sell a position in a backtest until it drops below a given screen rank. For example, let’s say you develop a model to hold 3 positions. Continue reading

Save and Share your Favorite Screens

It is now much easier to save your favorite screens so you can return to them tomorrow, next week, or next month, with just a few mouse clicks. All you do is click the “Flag Screen as a Favorite” link at the top right of any screen page.  Of course, you must be logged in so the site knows whose favorite it is – but you all knew that. You then give your screen a name and click OK. From then on, your favorite screen is available from the My Pages link on the top navigation bar and is also flagged for easy recognition on the My Recent Screens page and the Published Screens page – if it is a Published Screen? What’s a Published Screen? Continue reading

Of course, you must be logged in so the site knows whose favorite it is – but you all knew that. You then give your screen a name and click OK. From then on, your favorite screen is available from the My Pages link on the top navigation bar and is also flagged for easy recognition on the My Recent Screens page and the Published Screens page – if it is a Published Screen? What’s a Published Screen? Continue reading

New Charting for the New Year

We are excited to be introducing a new interactive charting package for the New Year. For a while now we’ve been searching for new charting tools and finally found an interactive charting package we think fits the site. Our goals were modest. We wanted to be able to scroll through time and we wanted to be able to click on a bar and view the price data.  We also like cross-hair scroll bars Continue reading

We also like cross-hair scroll bars Continue reading

Be Alerted with Price Alerts

This post introduces a new feature to the site – Price Alerts. This isn’t your basic simple price alert like your broker offers. Yes, you can enter a share price target as an alert, but you can also be alerted to price crossing above or below a moving average or a moving average crossing above or below another moving average. Also, if you prefer price retracements, you can set an x% retracement (up or down) from a point in time, and you will get an emailed alert when the retracement happens.

Several of you have requested something like this over the past few years, and we’ve been putting it off. Finally, we took your requests and built something around them. Alerts are built on top of Portfolios so you can easily create Alerts for one or more of your existing Portfolios. Or, if you create a special Portfolio for your Alerts, you still have all the functionality of standard Portfolios such as performance reports and screening. Continue reading

Several of you have requested something like this over the past few years, and we’ve been putting it off. Finally, we took your requests and built something around them. Alerts are built on top of Portfolios so you can easily create Alerts for one or more of your existing Portfolios. Or, if you create a special Portfolio for your Alerts, you still have all the functionality of standard Portfolios such as performance reports and screening. Continue reading

Hints for Good Backtests

Now that the new screener is up and running, and people are exploring the performance of their favorite screens, I want to pass along a hint or two about developing screens that test well.  There will likely be a follow up post, or two, to this one so if anyone wants to comment or otherwise share some of their expertise please do so.

First and foremost, focus on the group of funds you start with. Most of us want to begin with all funds and let our filter rules and our sorting rules determine the best from the rest. That’s asking a lot from our simple rules, especially if we include a number of overlapping, highly correlated, funds.  So the first suggestion is to narrow your list down to the basics and let each fund represent it’s sector of the market solely.  Continue reading

New Screener to Test

The past few months we have been working on a new ETF Screening module to replace our current Screener. We have put this new module through many structured tests but it needs some real world usage, so we are inviting you to try it out here. After some testing (and I’m sure a few changes) this module will replace our existing Screener page.

The user interface will be familiar to you, but there are a few significant changes. First is the ability to screen from a portfolio, or other predefined group of funds. As the fund universe has grown with many overlapping funds, and brokerage firms have offered commission free trades on select funds, it has become more important than ever to do some initial screening of the fund universe. By beginning your screening process with a portfolio of funds, you are in control from the first step forward. Continue reading

Page Changes and Twice the Updates

Tomorrow, Nov. 9th, we will roll out revised ETF Performance and RSF Trends pages. Nothing real new with the data, just a continuation of the new look we introduced with the Moving Average pages a few weeks back. However, existing links will not work directly with the new pages due to the menu changes. They will be auto-converted and you will be given the option to continue to the new page. After that, you will probably want to save the new link to avoid the extra step. If you want a sneak peak you can take a look at the revised ETF Performance Page and maybe try out your saved links by changing ‘etfperf.php’ to ‘etfperf2.php’. The new RSF Trends page can be seen here.  The other performance pages will be updated later this week.

If you see any issues with these new layouts please let us know with a comment or an email.

Also, beginning tomorrow we will be updating data every 30 minutes during the trading day. This has been an issue for a while for some of you and we are glad to be able to add these additional updates due to your continued support. The schedule will begin with our current 9:55 am ET update and continue through 3:25 pm. Then we will have our regular 3:45 update prior to market close and our 4:16 update after market close. The nightly update will continue as it has, at about 10:30 ET.

Enjoy, and let us know what you would like to see. We have some changes coming for the Screener next.